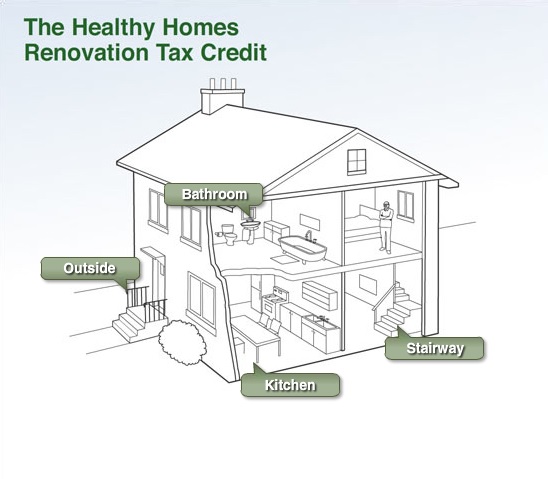

New tax credit for safer homes

Have you heard about the Government of Ontario’s Healthy Homes Renovation Tax Credit?

If you are over the age of 65 or live with someone who is senior, you could make your home safer and more accessible and the Ontario government will cover 15% of the costs. Up to $10,000 in renovations can be claimed.

At the Alzheimer Society, we understand that people with dementia, like other seniors, prefer to stay at home for as long as possible. Home can help preserve a sense of self and each year the move to a long-term care home is delayed saves $50,000 in health-care costs.

But home can also be a dangerous place for someone with dementia. The disease affects physical abilities as well as memory, judgment and insight. Here’s a list of upgrades that will make home safer for someone with dementia and also be covered by the tax credit:

• Grab bars around the toilet, tub and shower

• A raised toilet seat

• Non-slip flooring in the bathroom

• Handrails in corridors

• Wheelchair ramps, stair/wheelchair lifts and elevators

• Additional light fixtures throughout the home to make light levels are adequate throughout

• Improving outside steps

Before beginning any renovation, make sure it qualifies by calling 1-866-ONT-TAXS (668-8297).To learn more about the tax credit, visit the Government of Ontario’s website.