Still time to get a 2013 tax receipt and get the first-time donor’s super credit!

The end of the year is upon us, with only 2 days left to donate to the Alzheimer Society and receive a 2013 tax receipt. Because of generous supporters across the country, we are able to search every day for a cure for dementia and support those affected by this disease.

And if this is your first gift, or you haven’t made a charitable gift since 2007, there’s never been a better time to donate! The federal government’s First-Time Donor’s Super Credit means a greater tax credit on your donation.

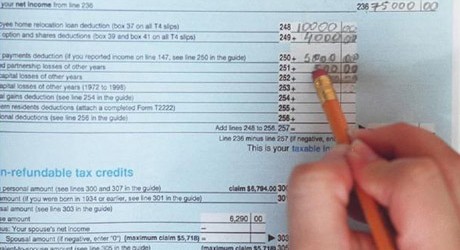

Here’s how it works:

The standard federal tax credit is 15% of the first $200 donated, and 29% for amounts beyond that. However, this super credit adds another 25% tax credit for donations up to $1,000!

This means that if you’re a first time donor, you could be eligible for:

- Donation of $200 or less: 40% federal tax credit

- Donation of $201 to $1,000: 54% federal tax credit

On top of that, when you add on provincial tax credits, your donation goes even further! In Quebec, your total credits earned on $1000 donation would be $744. In Ontario, it would be $611.

What else should I know about the First-time Donor Super Credit?

- It’s important to act quickly. The credit is only available until 2017.

- The credit can be shared between spouses and common-law partners, but the total claimed cannot exceed $1,000. Single Canadians can claim donations for up to $1,000 each.

- Non-cash donations, such as property or investments do not qualify.

- Only donations made in the same year of the claim qualify.

Check out this cool infographic and First Time Donor’s Super Credit Calculator at: www.ativa.com/first-time-donors-tax-credit

Learn more about the credit from the Canada Revenue Agency at: www.cra-arc.gc.ca/gncy/bdgt/2013/qa01-eng.html